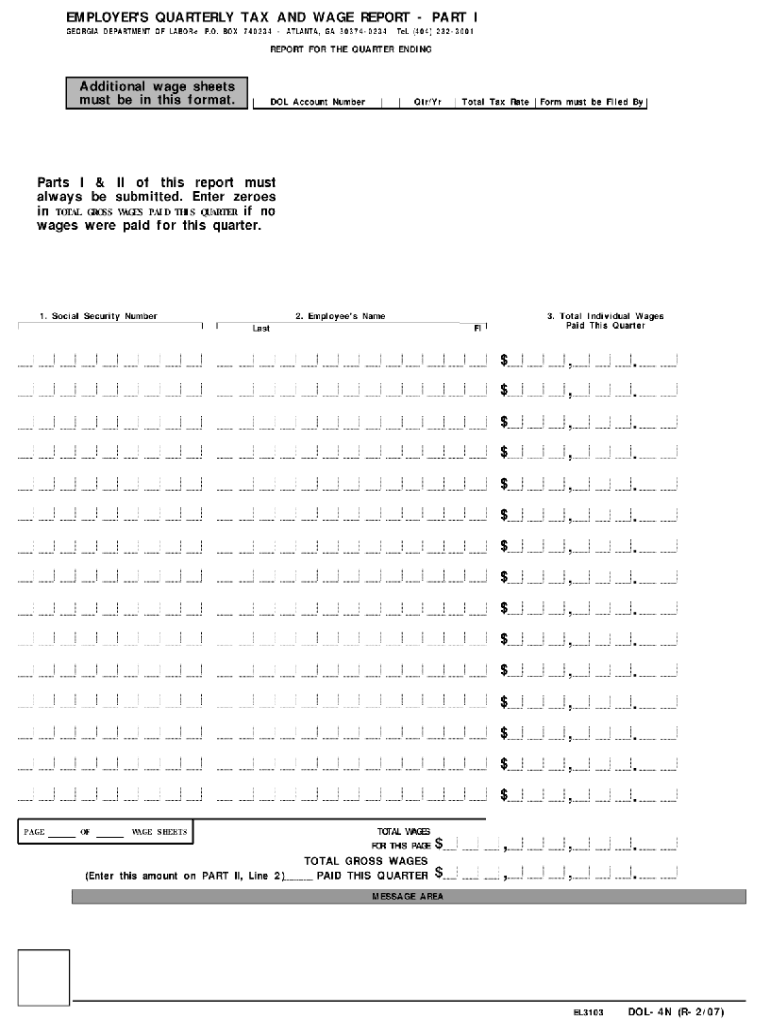

Who needs a DOL-4n Tax Report?

All liable for unemployment insurance employers in the State of Georgia must submit the 4 N also known as Employer's Quarterly Tax and Wage Report for each quarter of their financial activity.

What is DOL-4n Tax Report for?

This Georgia Tax Wage report is a summary of all wages that have been paid to each employee working for a business during the quarter period. Taxes are due only on the first $9,500 per employee per year. Qualified employers may defer quarterly taxes of $5.00 or less until January 31st of the following year.

Is DOL-4n Tax Report accompanied by other forms?

This form does not need to be accompanied by additional documents.

When is DOL-4n Tax Report due?

This form should to be filed before April 30th, July 31st, October 31st, and January 31st of the current year. Violation of terms can result in fines and prosecution.

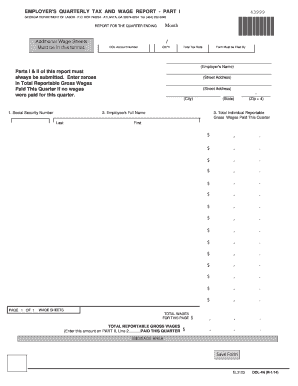

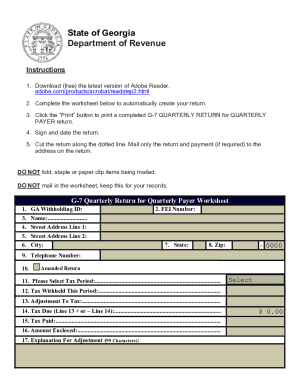

How do I fill out DOL-4n Tax Report?

DOL-4n is a two-page document; the following information must be provided:

- SSN and full name of each employee;

- Total individual wage paid for each employee;

- Total gross wages paid during the period;

- Taxable and non-taxable wages should be specified;

- Employer Change Request information in case when some personal information of the employer changed during the reporting period.

Where do I send DOL-4n Tax Report?

Completed and signed, this tax report should be directed to the following address:

Georgia Department of Labor, P.O. Box 740234, Atlanta, GA 30374-0234.